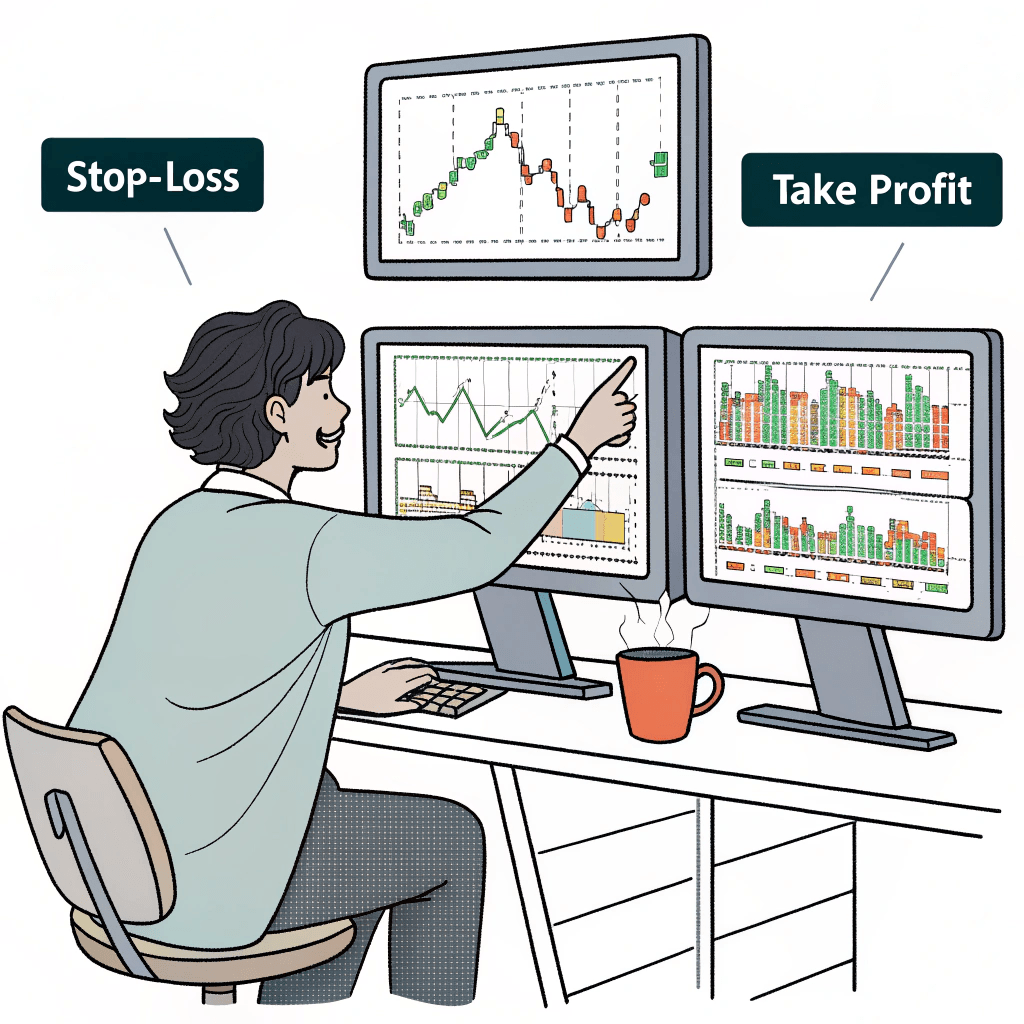

How to Use Stop-Loss and Take-Profit Orders in Crypto Trading

Introduction

In the volatile world of cryptocurrency trading, risk management is key to staying profitable. Two essential tools in any trader’s strategy are the stop-loss and take-profit orders. These tools help you manage risk by automatically closing your position when it hits a specific price. In this guide, we’ll explain how to use stop-loss and take-profit orders effectively to protect your trades and lock in profits.

What Is a Stop-Loss Order?

A stop-loss order is a type of order that automatically closes your position when the price reaches a level you set to limit your losses. For example, if you bought Bitcoin at $50,000 and set a stop-loss at $48,000, your position will automatically close if the price falls to $48,000, helping you prevent further losses.

Why Use a Stop-Loss Order?

Stop-loss orders allow you to manage risk by ensuring that you don’t lose more than you’re comfortable with. This is especially important in the highly volatile crypto market, where prices can swing dramatically in a short period of time.

What Is a Take-Profit Order?

A take-profit order is the opposite of a stop-loss order. It’s a tool that automatically closes your position when the price reaches a level where you’re satisfied with your profit. For example, if you bought Bitcoin at $50,000 and set a take-profit order at $60,000, your position will automatically close when the price reaches $60,000, securing your profit.

Why Use a Take-Profit Order?

Take-profit orders are helpful for locking in profits without needing to monitor the market constantly. They allow you to set clear profit targets and automatically exit trades when those targets are reached.

How to Set Stop-Loss and Take-Profit Orders

- Choose a Trade Pair: Select the cryptocurrency pair you wish to trade.

- Set a Stop-Loss Price: Determine the price level at which you want to cut your losses.

- Set a Take-Profit Price: Decide the price level at which you want to secure profits.

- Place the Orders: Enter your stop-loss and take-profit orders on your exchange platform.

- Let the Market Work: Once the orders are set, let the market execute the orders automatically when the conditions are met.