Day Trading Crypto: How to Profit from Short-Term Price Moves

Introduction

Day trading involves buying and selling crypto assets within the same trading day, aiming to profit from short-term price movements. Unlike long-term investing, day traders capitalize on volatility and small price changes to make quick profits. In this guide, we’ll cover the basics of day trading crypto, the strategies involved, and the risks you need to be aware of.

What Is Day Trading?

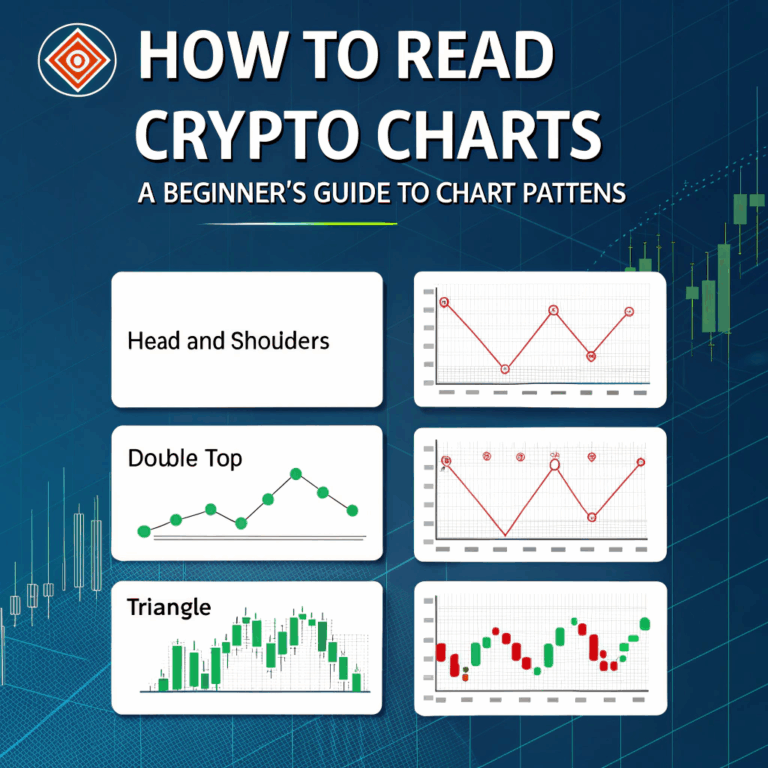

Day trading is the practice of entering and exiting positions within a single day to capitalize on intraday price fluctuations. The goal is to make small profits on each trade, which accumulate over time. Day traders often use technical analysis and chart patterns to identify short-term trading opportunities.

How to Start Day Trading Crypto

- Choose a Reliable Exchange: For day trading, you’ll need a platform with low fees and high liquidity. Popular exchanges like Binance, Kraken, and Coinbase Pro offer features tailored for day traders.

- Set Up Your Trading Plan: Decide on the amount of capital you’re willing to trade with, the types of trades you’ll focus on, and the time frames you’ll trade in (e.g., 1-minute, 5-minute, or 15-minute charts).

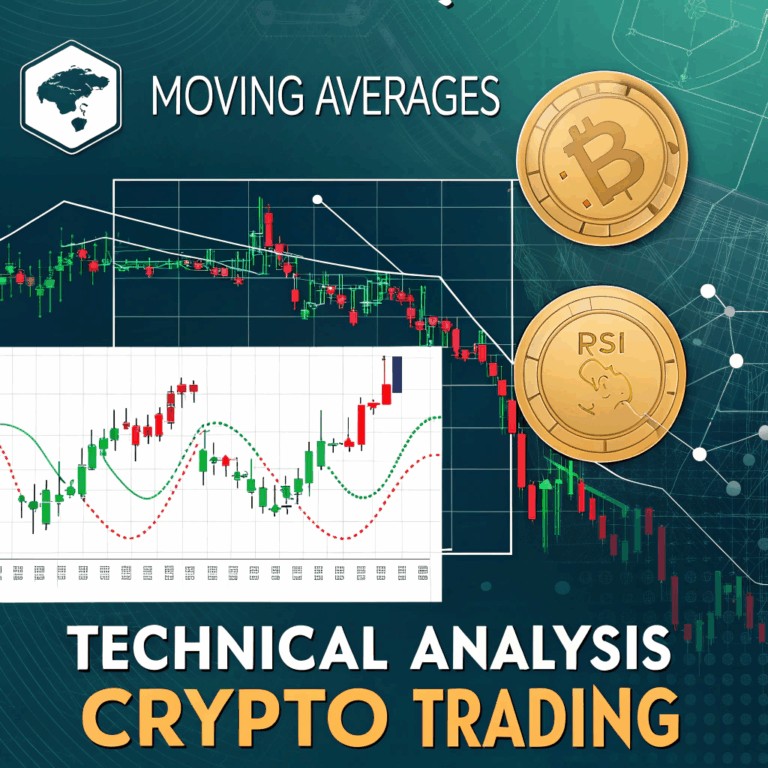

- Use Technical Indicators: Day traders often rely on indicators like RSI, MACD, and Bollinger Bands to identify overbought or oversold conditions and predict potential price reversals.

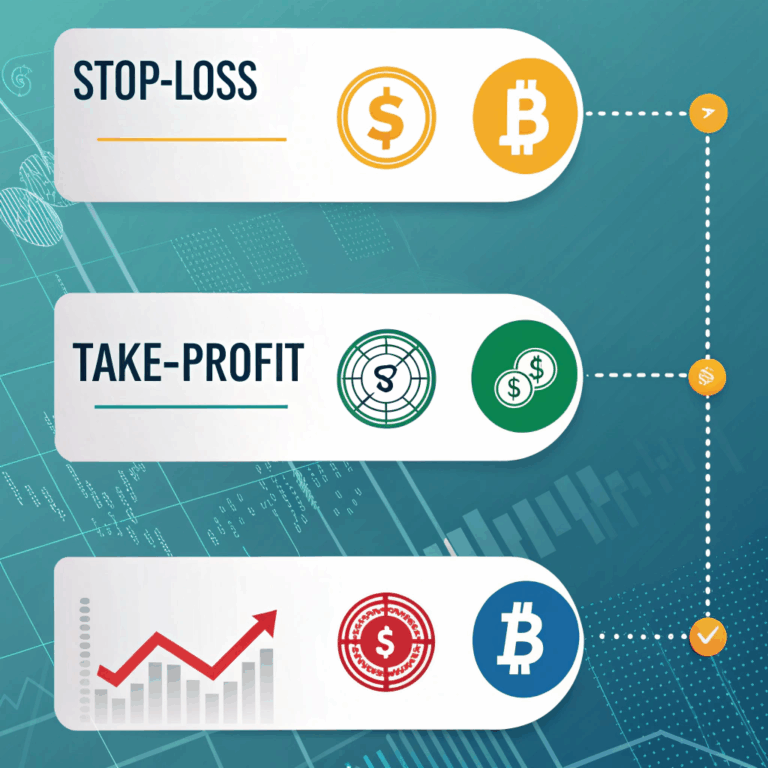

- Execute Your Trades: Once you’ve identified an opportunity, enter your position and exit once you’ve reached your profit target or stop-loss level.

Day Trading Strategies

- Scalping: This involves making rapid trades to capture small price movements throughout the day.

- Momentum Trading: Traders focus on assets with strong momentum, looking to enter the trade early and exit when momentum begins to fade.

- News-Based Trading: Reacting to news events that influence market sentiment and drive short-term price movements.

Risks of Day Trading

- High stress and constant monitoring of the market.

- Increased fees due to frequent trades.

- Risk of significant losses in volatile markets.