Cryptocurrency vs. Stocks: Which is Better for Investment in 2025

Introduction

Crypto and stocks are two of the most talked-about investment options in 2025. But they’re vastly different in how they work, the risks involved, and their potential returns. If you’re trying to decide where to invest your money, this guide compares both side-by-side to help you make an informed decision.

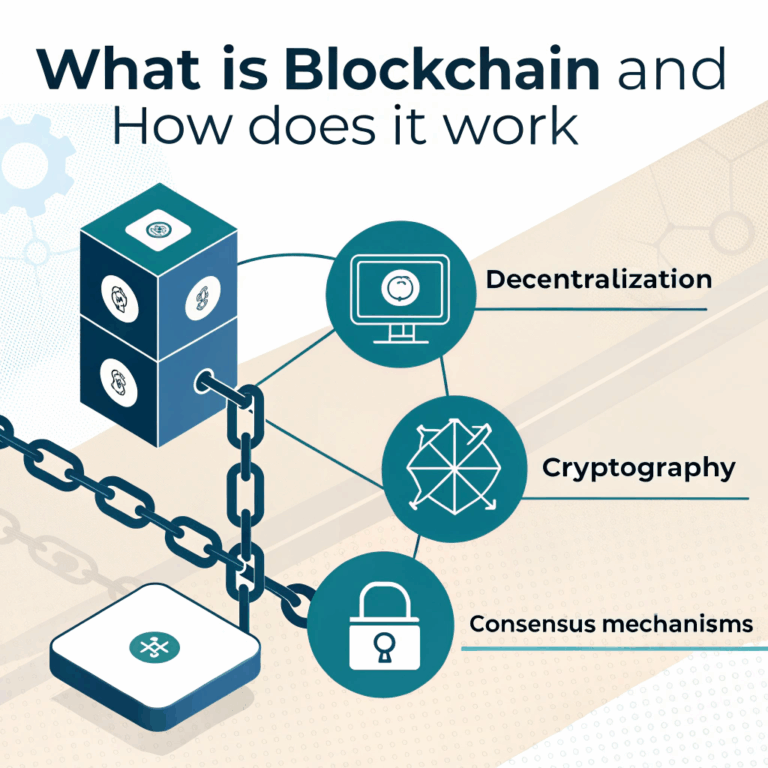

Understanding Cryptocurrency as an Investment

Cryptocurrency refers to digital assets like Bitcoin, Ethereum, and Solana. They run on decentralized networks using blockchain technology and can serve as currency, assets, or platforms for decentralized apps.

Characteristics:

- 24/7 trading

- High volatility

- Still considered speculative

- Often driven by hype, sentiment, and innovation

Understanding Stocks as an Investment

Stocks represent ownership in a company. When you buy shares, you own a part of that business and may earn money through dividends and price appreciation.

Characteristics:

- Regulated by financial authorities

- Historically stable with steady growth

- Tied to company performance and market fundamentals

- Only tradable during market hours

Key Differences Between Crypto and Stocks

| Feature | Cryptocurrency | Stocks |

|---|---|---|

| Regulation | Light or evolving | Heavily regulated (SEC, etc.) |

| Volatility | Very high | Moderate |

| Trading Hours | 24/7 | Weekdays, market hours only |

| Ownership | Digital asset | Business equity |

| Use Case | Currency, technology | Investment in companies |

| Security | Self-custody risk | Held with brokers and custodians |

| History | Less than 15 years | Over 100 years |

Pros of Investing in Cryptocurrency

- Potential for high returns

- Full ownership/control

- Global access with low entry barrier

- Rapid innovation in DeFi, NFTs, metaverse

- Decentralization and censorship resistance

Pros of Investing in Stocks

- Steady long-term growth

- Backed by real businesses with revenue

- Dividend income for passive earnings

- Strong legal protections and regulations

- Lower risk for conservative investors

Risks of Crypto vs. Stock Investing

Crypto Risks:

- Price crashes of 50% or more are common

- High risk of scams and hacks

- Regulation uncertainty

- Technology still evolving

Stock Risks:

- Subject to economic downturns

- Company mismanagement or bankruptcy

- Slower growth potential

- Market manipulation in small-cap stocks

Which Is More Volatile?

Cryptocurrency is significantly more volatile than stocks. While this means higher risk, it also opens the door to greater rewards for those who manage it wisely.

Which Offers Better Returns?

Historically, Bitcoin and Ethereum have outperformed the S&P 500 over the past decade. However, that comes with greater risk. Stocks offer more consistent, long-term returns — especially with dividends reinvested.

Liquidity and Accessibility

Crypto wins in terms of 24/7 access and global reach. Anyone with a phone can invest instantly. Stocks require brokerage accounts, bank links, and are only available during trading hours.

Regulation and Safety

Stocks are safer for beginners due to tight regulation, FDIC-insured brokers, and financial protections. Crypto, by contrast, puts more responsibility (and risk) on the individual investor.

Which is Better for Beginners?

If you want high growth and are comfortable learning and managing risk, crypto may appeal to you. If you prefer stable growth and a familiar financial system, stocks are a better fit.

Combining Both in a Diversified Portfolio

Many smart investors now combine both:

- Stocks for stability

- Crypto for growth potential

- Balance based on your risk profile (e.g., 90% stocks / 10% crypto)

This strategy allows you to enjoy the upside of crypto while reducing your overall exposure to its risks.

FAQ

Can I invest in both crypto and stocks?

Absolutely. Many investors split their portfolios to include both.

Which one should I start with?

If you’re conservative, start with stocks. If you’re tech-savvy and risk-tolerant, try crypto with a small amount.

Is crypto really a long-term investment?

It can be — especially Bitcoin and Ethereum — but requires patience and strategy.

Do I need separate platforms for each?

Yes. Stocks are traded via brokers like Fidelity or E*TRADE. Crypto needs exchanges like Binance or Coinbase.

Conclusion

There’s no one-size-fits-all answer to the crypto vs. stocks debate. It depends on your financial goals, experience level, and risk tolerance. In 2025, both offer compelling opportunities — and a smart investor knows how to leverage the strengths of each.