How to Create a Crypto Trading Strategy in 2025

Introduction

Success in crypto trading doesn’t happen by luck — it comes from having a clear, repeatable strategy. In this guide, you’ll learn how to create a crypto trading strategy that fits your goals, risk tolerance, and market style. Whether you prefer day trading or swing trading, building a solid framework is key to long-term success.

Step 1: Define Your Trading Style

Are you a scalper, day trader, swing trader, or position trader? Your time availability and risk appetite should determine your style.

- Scalping = Many small trades, short holding time

- Swing = Hold for days/weeks based on trends

- Position = Long-term, fundamentals-based trades

Step 2: Set Your Goals and Risk Tolerance

Ask yourself:

- How much capital are you trading?

- What’s your acceptable loss per trade (e.g., 1–2%)?

- How much profit are you targeting monthly?

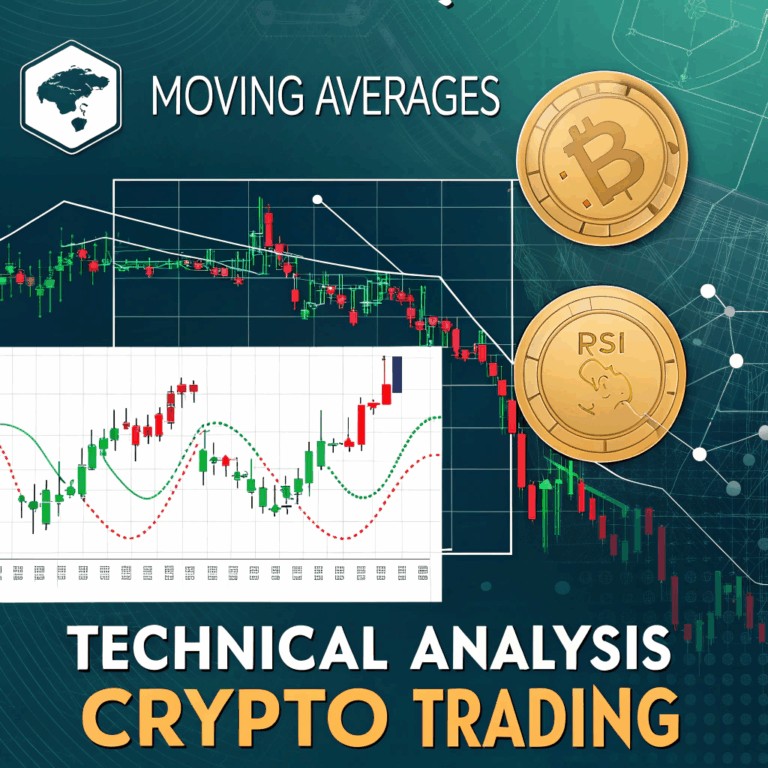

Step 3: Choose Your Indicators

A successful strategy often combines multiple indicators, such as:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- MACD

- Bollinger Bands

- Volume indicators

Step 4: Backtest and Optimize

Use platforms like TradingView, CryptoQuant, or CoinMarketCap’s simulator to test your strategy using historical data. Adjust parameters based on performance.

Step 5: Paper Trade or Start Small

Before risking real money, use paper trading to simulate your trades. Once confident, start with a small position and scale up gradually.