The Pros and Cons of Investing in Cryptocurrency

Introduction

Cryptocurrency has grown from an experimental idea to a major financial asset class. In 2025, millions of people worldwide hold crypto — whether as long-term investments, for daily use, or as part of a speculative portfolio. But is it a smart investment for you? Let’s explore the ups and downs.

Why People Are Investing in Crypto

From Bitcoin’s meteoric rise to DeFi innovations, crypto has proven it’s here to stay. People are drawn in by:

- Stories of early adopters becoming millionaires

- A desire to escape inflation and centralized banking

- The appeal of borderless, programmable money

But with great opportunity comes great risk — which we’ll now unpack.

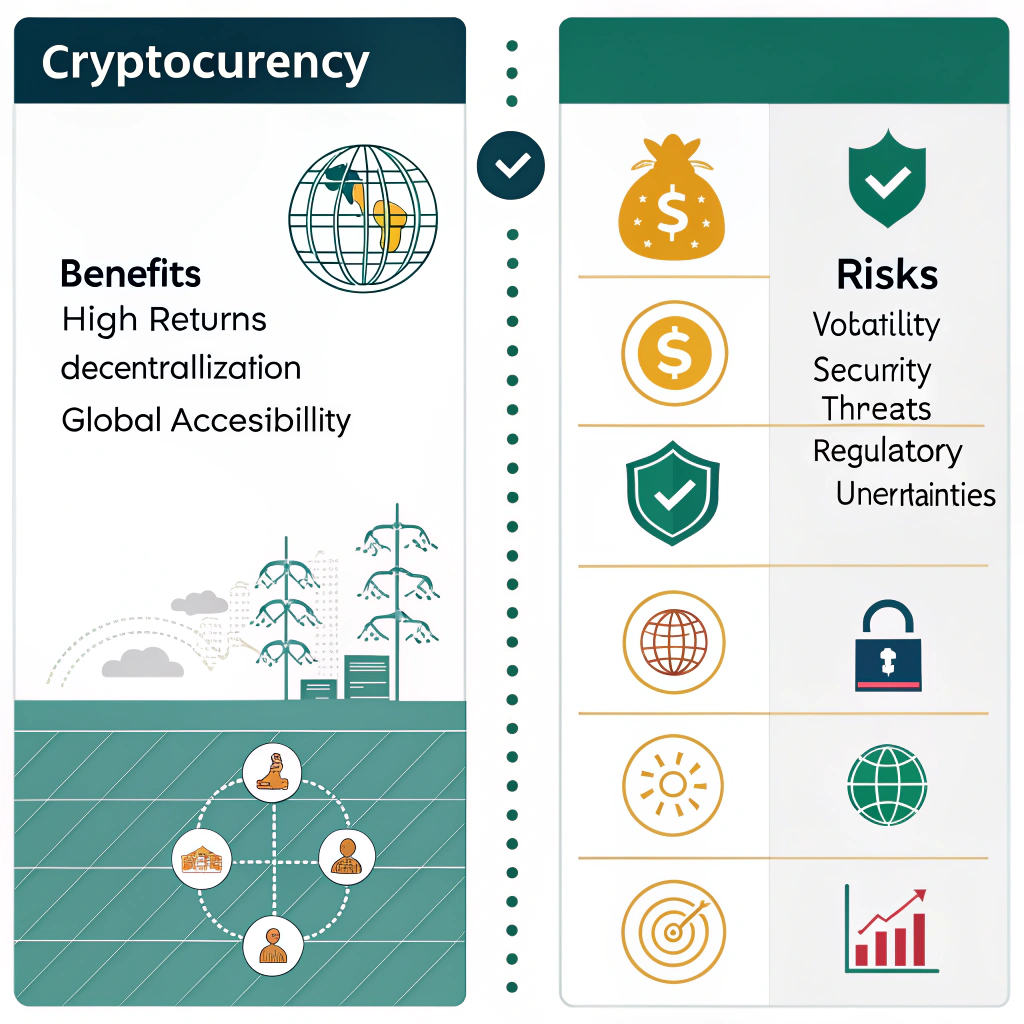

Pros of Investing in Cryptocurrency

High Return Potential

Cryptocurrencies are known for delivering massive returns in short timeframes. While high-risk, coins like Bitcoin and Ethereum have outperformed traditional assets over the past decade.

Portfolio Diversification

Crypto behaves differently from stocks and bonds. Including it in your portfolio may reduce overall risk through diversification.

Accessibility and Inclusion

You only need a smartphone and internet to start investing. Crypto opens financial services to the unbanked and people in restrictive economies.

Transparency and Control

Blockchain technology makes transactions transparent and auditable. You control your private keys, not a bank or government.

Decentralization

No middlemen. No closing hours. No censorship. Blockchain enables peer-to-peer transfers that can’t be blocked or reversed by third parties.

Cons of Investing in Cryptocurrency

Price Volatility

Crypto markets are notoriously volatile. A coin can rise 100% one week and crash the next. If you can’t stomach price swings, crypto may not suit you.

Regulatory Uncertainty

Governments around the world are still figuring out how to regulate crypto. Laws can change quickly, affecting prices and legality of services.

Security Risks and Scams

Hacks, rug pulls, phishing — crypto is full of threats. If you lose your wallet keys or fall for a scam, there’s often no recovery.

Lack of Consumer Protections

Unlike banks or traditional brokerages, there’s no safety net like FDIC insurance. If a platform collapses, your funds could be gone forever.

Complexity for Beginners

Gas fees, staking, wallets, seed phrases — it can be confusing. Mistakes are costly, and there’s little help available if you mess up.

Is Cryptocurrency Right for You?

Ask yourself:

- Can you handle market ups and downs emotionally?

- Are you willing to study and stay updated on tech and regulations?

- Do you want full control over your money (and full responsibility)?

If yes, crypto could be a worthwhile piece of your financial puzzle.

How to Reduce Risk When Investing in Crypto

- Only invest what you can afford to lose

- Diversify across projects, not just one coin

- Use cold wallets for storage

- Stick to well-known, reputable platforms

- Don’t follow hype blindly — DYOR (Do Your Own Research)

FAQ

Is crypto still risky in 2025?

Yes. While the market is more mature, it’s still high-risk and speculative.

Can I get rich from crypto?

It’s possible — but so is losing money. Smart, informed investing is key.

What’s safer: Bitcoin or altcoins?

Bitcoin is the most established and least risky crypto, but returns may be smaller than newer altcoins.

How much of my portfolio should be in crypto?

Experts suggest anywhere from 1% to 10% depending on your risk tolerance.

Conclusion

Cryptocurrency is a high-risk, high-reward asset class. It offers financial freedom, innovation, and potential — but demands caution, education, and responsibility. By understanding both sides of the coin, you can decide whether crypto investing fits your financial future.