What Are Crypto Trading Pairs? How to Trade Them Effectively

Introduction

In the world of cryptocurrency trading, trading pairs are one of the fundamental concepts every trader must understand. Whether you’re buying Bitcoin (BTC) with Tether (USDT) or swapping Ethereum (ETH) for USD Coin (USDC), understanding trading pairs is essential for success in crypto trading. This guide will help you understand what crypto trading pairs are, how they work, and how to trade them effectively in 2025.

What Is a Trading Pair?

A trading pair represents two different cryptocurrencies that you can trade against each other. In a trading pair, the first currency listed is the base currency, and the second one is the quote currency. For example, in the pair BTC/USDT, BTC is the base currency, and USDT is the quote currency. This means you’re trading Bitcoin against Tether, or in other words, buying or selling Bitcoin for Tether.

Base Currency vs. Quote Currency

- Base Currency: The first currency in the trading pair, which you are either buying or selling. For instance, in BTC/USDT, BTC is the base currency.

- Quote Currency: The second currency in the pair, which is used to determine the price of the base currency. In BTC/USDT, USDT is the quote currency, and the price of BTC is quoted in USDT.

Understanding this distinction helps you identify how much of the base currency you will get for a given amount of quote currency, or vice versa.

How to Read a Trading Pair

When you look at a trading pair on an exchange, the price represents how much of the quote currency is required to purchase one unit of the base currency. For example:

- If BTC/USDT is priced at 50,000, it means 1 Bitcoin costs 50,000 Tether.

- If ETH/BTC is priced at 0.07, it means 1 Ethereum is worth 0.07 Bitcoin.

The price of trading pairs is constantly fluctuating based on market demand, liquidity, and trading volume.

How to Trade Crypto Pairs Effectively

To trade crypto pairs effectively, follow these steps:

1. Choose Your Trading Pair

Choosing the right trading pair is essential to making a profit. Popular pairs like BTC/USDT, ETH/BTC, and ADA/USDT have high liquidity, which means you can execute trades easily. However, niche pairs may have more volatility but offer potential for higher returns.

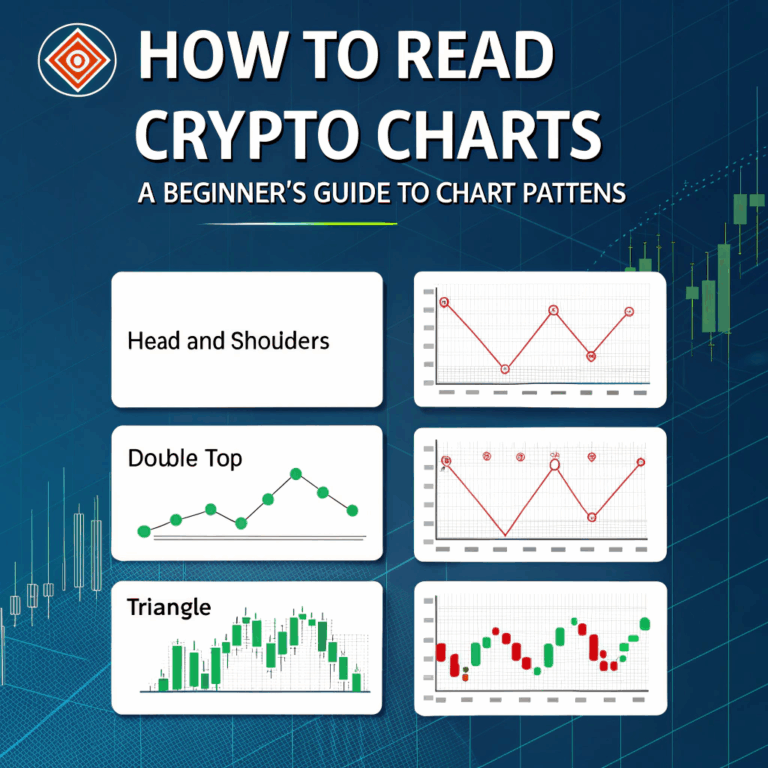

2. Analyze Market Trends

Before making a trade, it’s essential to understand the market conditions of both the base and quote currencies. This is where technical analysis comes in. Using tools like moving averages, RSI (Relative Strength Index), and support and resistance levels will help you make informed decisions on when to enter and exit a trade.

3. Monitor Liquidity and Volume

Liquidity refers to the ease with which you can buy or sell an asset without affecting its price. A pair with high liquidity (like BTC/USDT) will have smaller price spreads and more stable price movements. Volume is also important — high volume indicates active trading and often correlates with more accurate price movements.

4. Use Limit Orders to Control Entry and Exit

A limit order allows you to buy or sell a crypto asset at a specific price. For example, you may set a limit order to buy Bitcoin when its price reaches 48,000 USDT. This gives you more control over the price at which your order is executed, rather than using a market order that fills at the best available price.

5. Risk Management

Always use stop-loss orders to protect your investment in volatile markets. A stop-loss order automatically sells your asset if the price falls below a specified level, helping you limit potential losses.

Examples of Popular Crypto Trading Pairs

- BTC/USDT: The most common trading pair, used for buying Bitcoin with Tether or selling Bitcoin for Tether.

- ETH/USDT: Ethereum traded against USDT, popular for DeFi investments.

- ADA/USDT: Cardano’s ADA token traded with Tether.

- BTC/ETH: A pair for traders who want to trade Bitcoin for Ethereum and vice versa.

- SOL/USDT: Solana traded against Tether, popular for Solana-based projects.

How to Trade with Crypto Pairs Effectively

Understanding how crypto trading pairs work and applying the right strategies will allow you to maximize your trading opportunities. Here are some key points to remember:

- Research both assets in a trading pair before making decisions.

- Use technical analysis to identify entry and exit points.

- Monitor market conditions and keep an eye on the overall trends of both currencies in the pair.

- Use tools like stop-loss and limit orders to manage risk effectively.

Trading crypto pairs can be extremely profitable if done correctly. By following the right strategies, conducting thorough research, and applying risk management techniques, you can enhance your trading performance and boost your chances of success in 2025.