What Is Technical Analysis in Crypto Trading?

Introduction

Technical analysis (TA) is a crucial skill for anyone looking to trade cryptocurrency effectively in 2025. By studying past price movements and using tools like charts, indicators, and patterns, traders can predict potential future price movements. This article will walk you through the essential components of technical analysis and how you can use them to improve your crypto trading strategy.

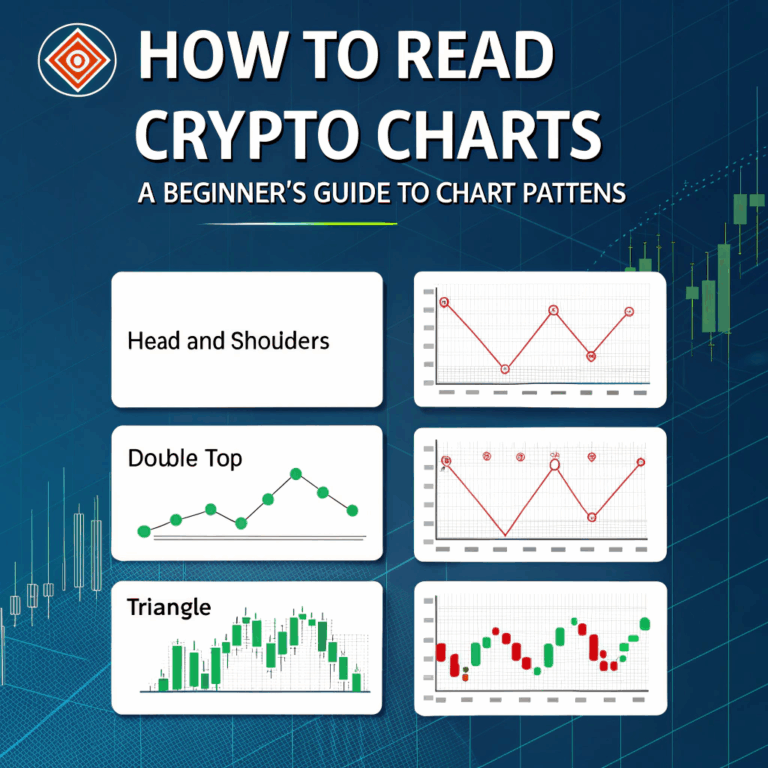

Understanding Candlestick Charts

Candlestick charts are one of the most commonly used tools in technical analysis. Each candlestick represents price movement within a specified time frame (e.g., 1 minute, 1 hour, 1 day). A candlestick consists of:

- The body (the difference between the opening and closing price),

- The wick (the highest and lowest price reached during the period).

Candlestick charts help traders identify price trends, reversals, and patterns. For instance, a bullish engulfing pattern signals that the price may go up, while a bearish engulfing pattern suggests a potential downward trend.

Key Indicators in Technical Analysis

Indicators are mathematical calculations based on price and volume data. These indicators help traders analyze market trends and make decisions based on market behavior. Some of the most important indicators include:

- Moving Averages (MA): Moving averages are used to smooth out price data and identify trends. The most common types are the Simple Moving Average (SMA) and Exponential Moving Average (EMA).

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It’s used to determine overbought or oversold conditions in a market.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. It’s used to identify potential buy and sell signals.

Support and Resistance Levels

Support and resistance levels are horizontal lines drawn on a chart that indicate where the price has historically reversed direction. Support refers to a price level at which an asset tends to stop falling and start rising, while resistance refers to a price level at which an asset tends to stop rising and start falling. Identifying these levels helps traders make better decisions on entry and exit points.

Trend Lines

Trend lines are straight lines that connect a series of price points. These lines help traders identify the direction of a market trend. An upward trend line connects higher lows, while a downward trend line connects lower highs. Trend lines can be used in combination with other indicators to confirm price movements.